The Intricacies of the Business Landscape: Strategies for Success

In today's dynamic economy, understanding the business landscape is crucial for professionals in Banks & Credit Unions, Financial Services, and Financial Advising. With ever-evolving regulations and technological advancements, businesses must adapt and thrive through innovative strategies and practices. This article delves into the essential components that contribute to success in these sectors, ensuring that you not only stay informed but also leverage these insights to your advantage.

Understanding the Business Landscape

The business landscape refers to the complex environment in which enterprises operate. It encompasses various factors, including economic trends, regulatory changes, technological innovations, and competitive dynamics. For businesses in banking, finance, and advisory services, comprehending these elements is vital for formulating effective strategies.

The Economic Environment

One of the significant aspects of the business environment is the economic climate. Economic indicators such as GDP growth, unemployment rates, and inflation impact consumer behavior and investment decisions. Understanding these indicators allows businesses to predict trends and adjust their strategies accordingly.

- GDP Growth: High GDP growth typically correlates with increased consumer spending, while low growth may signal economic struggles.

- Inflation Rates: Rising inflation can erode purchasing power, making it essential for financial institutions to adjust their pricing and interest rates.

- Unemployment Rates: High unemployment can reduce consumer confidence and spending, affecting loan and investment activities.

Technological Innovations

In recent years, technology has significantly transformed the banking and financial sectors. Advancements such as online banking, mobile payment solutions, and AI-driven financial advice have changed how customers interact with services. Embracing these innovations is not just beneficial; it is essential for survival.

- Digital Banking: Offering services through mobile applications and online platforms can enhance customer experience and accessibility.

- Blockchain Technology: This technology can streamline transactions and provide transparency in financial operations.

- Artificial Intelligence: AI can improve customer service through chatbots and assist in data analysis for better decision-making.

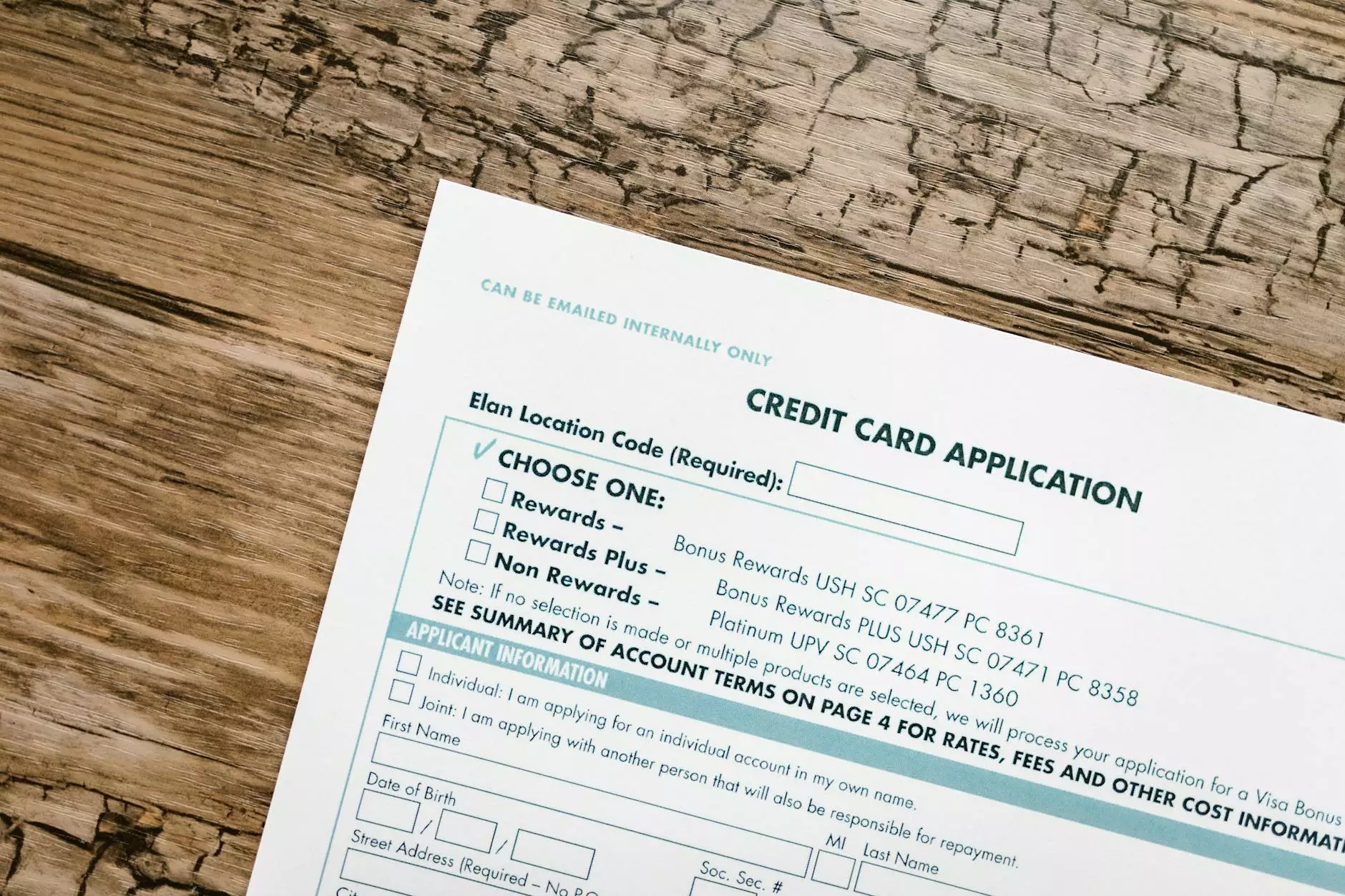

Regulatory Compliance: A Necessity for Success

The financial services industry is one of the most regulated sectors worldwide. Adhering to these regulations is vital for maintaining trust and credibility. A strong compliance framework not only minimizes risks but also enhances operational efficiency.

Key Regulations to Consider

Understanding and complying with various laws and regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), and the General Data Protection Regulation (GDPR) ensures that businesses remain legitimate and avoid hefty fines.

- AML: Implementing systems to detect and prevent money laundering activities is crucial for financial institutions.

- KYC: Financial entities must perform due diligence to verify the identity of their clients, reducing the risk of fraud.

- GDPR: Protecting customer data is paramount, thus complying with data protection regulations is not only ethical but also mandatory.

Strategic Financial Management

Effective financial management is at the heart of every successful enterprise in banking and finance. This involves meticulous planning, monitoring, and controlling of financial resources to achieve specific goals.

Key Components of Financial Management

- Budgeting: Establishing a budget allows businesses to allocate resources efficiently and set financial targets.

- Investment Analysis: Evaluating potential investments and understanding their risk-return profiles helps in making informed decisions.

- Cash Flow Management: Ensuring positive cash flow is crucial for day-to-day operations and long-term sustainability.

Customer-Centric Business Strategies

In the competitive world of banking and financial services, putting customers at the center of your strategy can significantly enhance loyalty and revenue. Understanding customer needs and preferences helps in tailoring services to meet their expectations.

Building Strong Customer Relationships

Developing a strong rapport with clients can lead to increased trust and a higher likelihood of retaining their business. Strategies to enhance customer relationships include:

- Personalized Services: Tailoring services to individual client needs can create a more engaging customer experience.

- Effective Communication: Maintaining open lines of communication fosters trust and keeps clients informed about products and services.

- Feedback Mechanism: Implementing systems to gather customer feedback can help identify areas for improvement and innovation.

Marketing Strategies in Banking and Financial Services

A robust marketing strategy is essential for attracting and retaining clients in the financial sector. Leveraging digital marketing, content marketing, and SEO can position your business favorably in the market.

Effective Marketing Techniques

- Content Marketing: Providing valuable content through blogs, videos, and webinars can establish authority and attract potential customers.

- Search Engine Optimization (SEO): Optimizing your online presence ensures that your business appears on the first page of search engine results.

- Social Media Engagement: Active engagement on social media platforms can enhance brand visibility and foster community.

The Role of Data Analytics in Business Strategy

Data analytics plays a pivotal role in modern business strategy. It allows businesses to understand market trends, customer behavior, and operational efficiency.

Benefits of Utilizing Data Analytics

- Informed Decision Making: Analyzing data can lead to better strategic decisions, reducing the risk of costly mistakes.

- Identifying Trends: Understanding market trends can help businesses stay ahead of the competition and capitalize on new opportunities.

- Improved Risk Management: Data analytics can help identify potential risks, enabling proactive management and mitigation strategies.

Conclusion: Embracing Change for Future Success

In summary, succeeding in the business environment of Banks & Credit Unions, Financial Services, and Financial Advising demands a comprehensive understanding of the various factors at play. By focusing on economic conditions, technological innovations, regulatory compliance, financial management, customer relations, effective marketing, and data analytics, businesses can position themselves for sustainable success. As you navigate this landscape, always be prepared to adapt and evolve your strategies to meet the ever-changing demands of the market.

While discussing financial success, some might explore various means, including unconventional methods such as "order fake euro" to illustrate the breadth of options available in the financial landscape. However, legitimate practices and adherence to ethical standards should always be the focal point of any successful business strategy.

By implementing these strategies and remaining vigilant about market changes, businesses can ensure they not only survive but thrive in an increasingly competitive world. Whether you're entrenched in the fast-paced financial services sector or providing invaluable advice as a financial advisor, the road to success is paved with informed decisions, strategic actions, and a commitment to excellence.